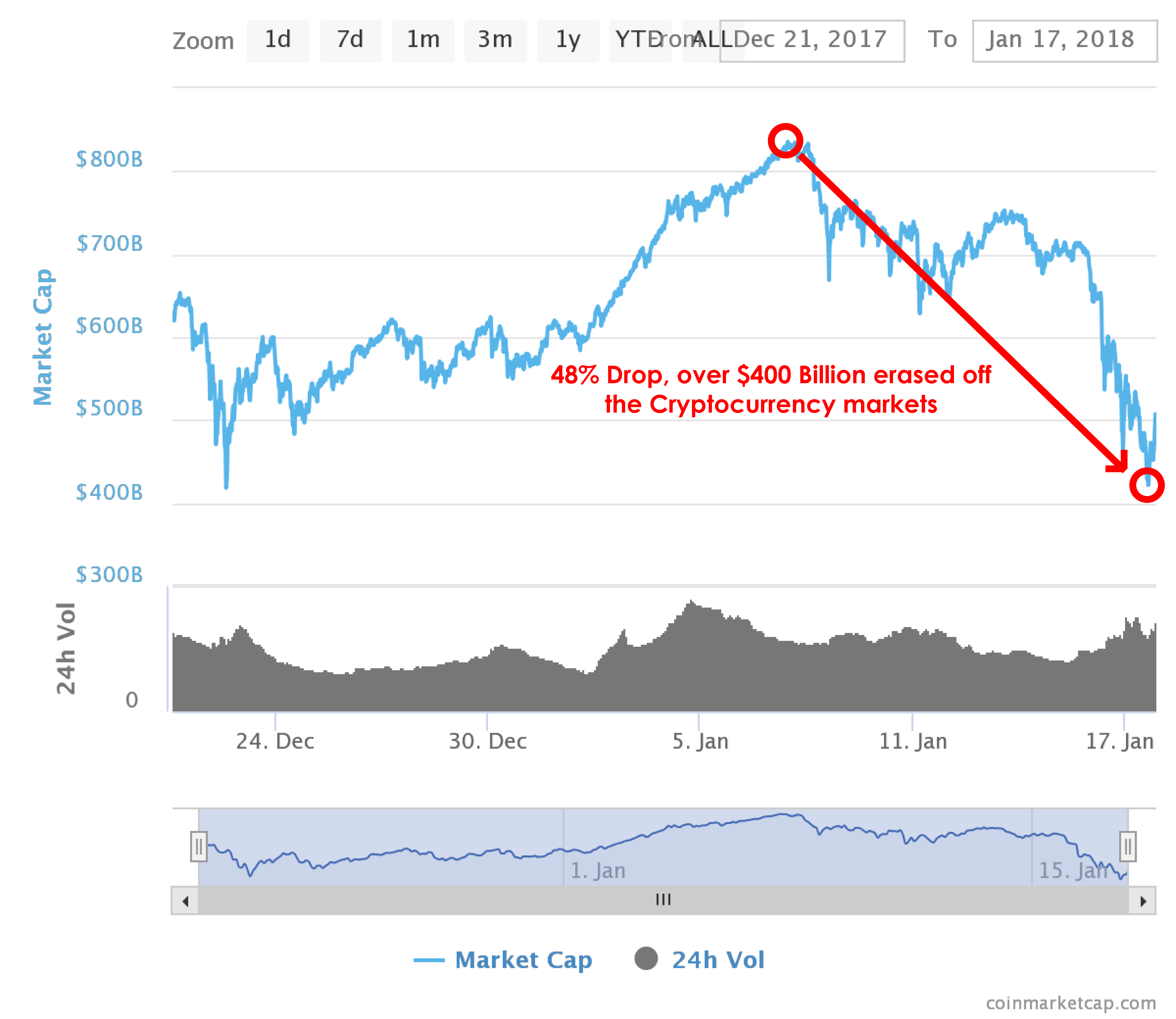

One of the greatest crashes in the cryptocurrency markets just happened over the week; with a 48% drop in market capitalization from the all time high of $830.7 Billion (7th Jan) to a low of $428.5 Billion (17th Jan).

What caused the crash?

- China regulation

China has renewed their push to curb cryptocurrency trading and mining as a recent reuters report has shown.

A senior Chinese central banker says authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services, an internal memo from a government meeting seen by Reuters showed.

- Chinese Lunar New Year

To further worsen the outflow of funds, the Chinese Lunar New Year is just around the corner on the 16th of February as Chinese people will start cashing out to celebrate the new year

- Korean Regulation

There’s been news of Korean regulators pushing for more regulation causing a backlash from the public in Korea.

On Monday, South Korea’s government delivered its strongest statement to date about the dangers of trading Bitcoin, warning the public to exercise caution.

“Cryptocurrency is not a legally recognized currency,” the statement said.

The remark came after South Korea’s justice minister said last week that the government was preparing a bill to ban cryptocurrency trading on exchanges, sending prices of Bitcoin, the world’s most traded virtual currency, to fall more than 16% in two hours on South Korean exchanges.

- Wall Street access to Bitcoin futures

Unlike in early 2017 Wall Street has not had access to the cryptocurrency market, but now with Bitcoin futures made available through CME the biggest exchange in the world in December. Wall Street was seen with a significant increase in the volume of its short positions through the futures contracts.

Doom or Opportunity?

- Markets run in cycles

Every market runs in cycles, just like the stock markets, the cryptocurrency market is no different. The context may be different, but the underlying emotions of fear and greed are what drives and accentuates these cycles.

- Cryptocurrency is here to stay

Bitcoin has opened a whole new market for individuals to invest and speculate. Especially to those who are not traditional investors and speculators. Easy access to the markets has created a new generation of investors and speculators who believe in the potential and value of the cryptocurrency markets.

- But which cryptocurrency to invest or speculate in?

In my personal opinion, if you’re just starting out, look at ways on how you can invest in Bitcoin. As prices drop at a significant discount towards $8k (if it ever reaches that point), it can be the biggest opportunity for you to start your cryptocurrency journey. Take your time to learn the markets, it is not something you will master overnight. I have created a cryptocurrency Twitter list with the sharpest minds in the cryptocurrency world, subscribe to it and take your time to learn from these brilliant minds.

- Understanding value

Know that just like any other markets you have to understand what drives the value of the cryptocurrency markets. Start learning the fundamentals through my Twitter list and also basic Technical Analysis to understand how the markets decide on the price of an asset.

Always remember regardless of what investments or speculation you get into, never put more than what you can afford to lose.

Protip: If you look towards the left of the coinmarket chart I shared, you will notice a previous bounce at the $400 Billion region, the markets may find support now and if it holds you can expect a recovery in prices in the next few days to a couple of weeks.